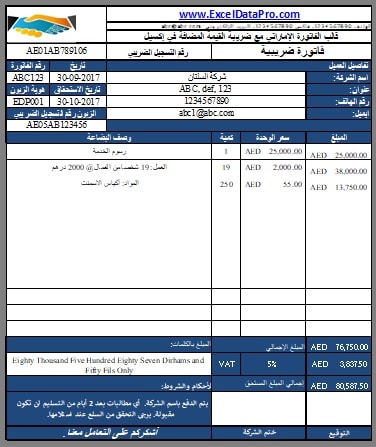

Vat Invoice Format In Excel

VAT stands for Value Added Tax and the invoice mentions the details about how much tax is to be applied for a particular item or the service rendered. The VAT invoice is a document that notifies an obligation to make a payment. Best VAT Tax Invoice Template can help you your business become more efficient in financial matters. Now UAE tax invoice in excel is now available here to make your invoicing matter easy and efficient. To tell the truth, all authorize and expense enlisting organizations ought to have an assessment data display in their bills. This Excel template, just like the default template shipped with Invoice Manager for Excel (UIS), has two taxes defined on the invoicing form. According to UK HM Revenue & Customs VAT invoices, what they must show, it must show. Mail it or send a PDF: When sending an invoice to a client, either print and mail a paper copy, or send a PDF. It is not as professional to send an invoice in an editable format like an Excel or Word document. It is extremely easy with Excel 2010 or later to create a PDF - Just go to File Save As and choose PDF.

GST Invoice Format Guide

Invoices are instruments that act as evidence of goods or services or both being sold by a business to its customers. These are the documents used by businesses to collect payments from buyers for the underlying sale transactions.

Therefore, invoices contain details such as the goods or services sold, their quantity, price and terms of supply, tax applicable on such goods or services etc.

The GST law makes it necessary for registered taxpayers to issue invoices for the sale of goods or services. This is because the tax invoice not only enables the seller to collect payments, but also avail input tax credit under GST regime.

Now, there are different types of invoices that are issued under the GST law. These depend on various factors such as the type of the registered taxpayer, nature of goods or services supplied, payment terms etc.

For instance, registered taxpayers supplying goods or services of value less than Rs. 200 are not required to issue any invoice. Similarly, taxpayers supplying exempted goods or exempted services under GST need to issue a bill of supply in place of a tax invoice.

Since invoices are needed for purposes ranging from recording sales, collecting input credit, to protecting a business from fraudulent activities etc, these form an indispensable part of your business.

Hence, you must know the format and particulars that go into creating tax invoices so that you can create invoices correctly and undertake business transactions effortlessly.

You can read our GST invoice guide and article on invoices in GST to know GST invoice components and types.

This article will help you learn GST invoice format in Word and Excel and how QuickBooks Online can help you generate GST ready invoices within no time.

Try QuickBooks Invoicing & Accounting Software – 30 Days Free Trial.

GST Bill Format Samples

Download PDF GST Invoice Format Samples

Download GST Invoice Format in Word

GST Invoice Format in Excel

Here are the steps you need to follow to create GST invoice using excel:

Open Microsoft Excel, click on ‘File’ tab and then select ‘New’ from the dropdown. Then, double click on the ‘Blank WorkBook’ to open a fresh excel sheet.

To remove the gridlines for preparing the invoice, click on the ‘View’ tab and then uncheck ‘Gridlines’ in the ‘Show/Hide’ section.

Once you have the blank worksheet, click on the ‘Insert’ tab and upload your company logo in the worksheet. Put the header for the document as ‘Tax Invoice’.

After putting the company logo and document heading, the next step is to enter your company details such as company name, address, zip code and GSTIN

The next section in invoice is the ‘Bill to’ section which contains the details of your customer. Write ‘Bill to’ just below your company details and enter customer information like company name of the customer, address, zip code, GSTIN/UIN.

Further, add other details like the purchase order number (PO) if any, invoice date, invoice number and invoice due date. You can use the formula =TODAY() function in invoice date section for ease since it uses the current day’s date.

Further, say your payment terms are Net 20, that is, 20 days from the bill date. So, you can use the formula =TODAY()+20 for the invoice due date cell for ease.

Then, add goods or services details section that includes goods/ service details, price (per SKU), quantity, discount % if any, tax applicable if any. To make your work easy and use this invoice as a template for future invoices, you can use formulas.

For instance, use the product formula if you have multiple SKUs and their prices. Say, you have to provide 50 units of an item at Rs. 10,000 each, use PRODUCT function to calculate total price of 50 units as Rs. 5,00,000 in the total column. Similarly, you can use the SUM function to calculate total invoice value, adding final values of all SKUs.

Towards the end of the invoice, provide your bank details, company PAN and space for your digital signatures.

You can also create a GST invoice using Microsoft Word. Here are the steps to create an invoice in Microsoft Word:

Open Microsoft Word to have the blank word document.

Click on the ‘Insert’ tab and click on ‘Table’ from the selection window. From the dropdown, select ‘Insert Tables’ and change the number of rows and columns as per your need. Say, you need a 6 by 14 table – that is the one having 6 columns and 14 rows.

Adjust the size of each column as per the details to be included in a specific column. You can do that by clicking on the ‘Layout’ tab and changing the dimensions in the ‘Width’ section.

Now enter your company details such as your company name, address, ZIP and GSTIN. For instance, 349/1, ABC View, Street No.9, Grand Road, Gurugram, 122001

Next, provide other details such as the invoice date, purchase order number and invoice due date.

Once this information is provided, you need to put down your customer details. These include your customer company name, address, ZIP and GSTIN/UIN details.

Below the customer details, include a section that describes the goods or services sold, HSN/SAC codes, quantity, price, their total amount and GST rates applicable.

Since you will not be able to use formulas in Word, you will have to keep handy all the calculation and put the final figures in the respective sections.

Towards the end of the invoice, include your bank details such bank name, account number and IFSC code.

Finally, provide a section for the signatures of your company’s authorized signatory.

Are Word and Excel Best Choices for Creating Invoices?

Excel is outstanding when it comes to calculating almost everything. Formulas in Excel make calculations like tax amount, total taxable values etc really easy.

Word too helps in creating customized invoices with its broad range of functions like inserting tables, merging cells, design functions etc. However, you need to be ready with the calculations and put them manually in Word.

Both these tools might enable the medium and small business owners to create custom invoices, but these are not the ultimate ways of doing so. QuickBooks Online accounting software helps you create GST ready invoices anytime, anywhere within minutes.

Here are the areas where both Excel and Word fail to help you much with creating GST compliant invoices easily :

Word and Excel certainly enable business owners to create customized invoices. But these involve extra time and work.

For instance, whenever adding different goods or services, you need to update the same in each invoice template.

Further, sending invoices via email also requires additional effort. This consumes the valuable time of the business owners and hampers their productivity.

Say for instance, you have all your customer information stored in the excel sheet. Now, looking for specific customers to whom you want to send invoices would involve tremendous search from the excel database.

Further, there are chances of information getting accidentally deleted or your system crashing, making you lose the priceless data.

Whenever you create invoice templates on Word and Excel, they remain saved in your system. These do not give you the advantage of creating and sending invoices on the go – say while traveling for a business meeting or in the field at a job site.

Thus, this inability to create and send invoices anytime, anywhere translates into lost time and productivity.

Now, let’s see how you can create custom GST Bills within minutes using QuickBooks Online Accounting Software.

Creating GST Ready Invoices Using QuickBooks Online

QuickBooks has a free online invoice generator that allows you to create customized invoices easily, within no time.

Creating customized GST compliant invoices in QuickBooks Online is simple and intuitive. Here’s all you need to do:

Vat Invoice Template Excel

You can begin with adding your company details. These include:

- Company name

- Address

- City

- ZIP

- Phone number

- GSTIN

- Bank name

- Account Number

- IFSC Code

- Company PAN

Vat Tax Invoice Format In Excel Free Download

Further, you can enhance the invoice by uploading your company logo. The company details, once saved in the software, would automatically reflect on all of your future invoices.

Also, with QuickBooks Online, you can customize your invoices by adding colors and using fonts that match your brand style guide. Likewise, changing invoice details can be done with just a few clicks, with no cell formatting and resizing needed.

Next, you can easily add all your customers in QuickBooks Online by adding their details. You can also sync your excel sheet with the software to upload the list of customers with their details.

Since all your customers are now saved with QuickBooks Online, pulling specific customer details for raising invoices is really easy. All you need to do is select the specific customer from the dropdown while creating the invoice. The remaining customer information such as billing address, email id gets automatically filled.

Much like customers and your company information, QuickBooks enables you to to create products/services that your business offers. This helps you to save all your product/service information, know trends items of best selling items etc.

While creating invoice for a specific customer, all you need to do is simply choose the product/service from the dropdown and add description. Further, simply add the tax details with just a few clicks and your GST invoice is good to go.

Now, you can save the invoice so created or save and send the same from within the software with just a click.

How Does QuickBooks Online Make Online Invoicing Easy?

With QuickBooks Online, you can create GST ready invoices easily as it:

- has in built data fields necessary for GST compliance that make GST online invoicing easy. So, you save time and effort in preparing GST bill formats manually.

- enables you to customize invoices by adding company logo, enhancing colors or using fonts to match your brand style guide or simply use in built invoice templates

- allows you to import your own invoice formats and map invoice details with QuickBooks data fields

- helps you receive payments faster by creating and sending customized invoices to your customers from any device, wherever you go

You May Also Read:

Check GST – HSN Code

Who Should Register for VAT/Sales Tax in Pakistan

All businesses and suppliers of taxable goods must register for Pakistani sales tax via FBR’s online portal. Generally, tax registration will also require an in-person meeting. In order to process the application, you will be asked to provide the following:

● Business name

● Business address

● Business bank accounts

● Tax identification business directors

● Passports of business directors

Any Pakistani business that fails to register for sales tax may be fined. Since there is no threshold for businesses required to register for sales tax, most businesses will have to register with BIR. Although the registration threshold is nil, businesses with low business turnover may be eligible for a simplified sales tax scheme. Sales tax is due in Pakistan at the time of supply or at the time of payment.

Businesses registering with FBR for sales tax will receive a Sales Tax Registration Number (STRN) or User ID and password that will be used in all electronic filing for sales tax returns. Unlike many countries, non-resident businesses operating in Pakistan may not register for sales tax, regardless of turnover.