Gann Square Of 9 Excel

How to use Gann's Square of Nine Intraday Calculator Gann Square of 9 - Introductio. This calculator is meant for trading only intraday. Enter the LTP ( or WAP - Weighed Average Price )of any stock / index/ underlying anytime during the market hours. The ideal time is 15min - 1hr after market opens. Intraday Trading using Gann square of 9 Calculator Gann square of 9 calculator is used to generate support and resistance levels for intraday trading. The supportresistance levels are generated using the values in Gann square.

- Gann Square Of 9 Excel Sheet

- Gann Square Of Nine Excel Formula

- Gann Square Of Nine Software

- Gann Square Of Nine

- How To Make Gann Square Of 9 In Excel

Interested in Trading Risk-Free?

Build your trading muscle with no added pressure of the market. Explore TradingSim For Free »

Gann

Who is Gann?

The trading concepts used by William Delbert Gann, or W.D. Gann as he is fondly called, bring feelings of intrigue and mystique.

He is primarily known for his market forecasting abilities, such as the Gann square of nine which combine a mix of geometry, astrology, and ancient math techniques. Gann started trading at the age of 24 and was a religious man.

Gann was also a 33rd degree Freemason [1], to which some attribute his knowledge of mathematics and ratios.

For the most part, Gann’s works have been open to interpretation. Therefore, to trade based on Gann’s methods requires extensive practice and understanding.

Understanding Gann

Unlike trading with technical indicators where you can buy or sell when some variables are met, trading with Gann’s methods is not as straightforward. This is because learning the methods takes time. You can’t just apply a few moving averages to the chart and give it a go.

The other challenge is there are no clear Gann trading strategy experts to learn from. So, why are traders still holding on to techniques defined in the 20th century?

My take is that it’s so complex and hard to decipher, this leads traders to believe there must be something there.

Among the many trading methods known to Gann, the square of nine is quite popular.

What is the Gann Square?

Squares, circles, and triangles are the three most common geometric shapes that form the basis for most of Gann’s work.

Gann’s wheels and squares are some of the most common applications and form the cornerstone of Gann’s work.

For example, Square of nine, Square of 144 and the Hexagon are some of the many works from Gann that are popular.

Square of Nine

The square of nine or Gann Square is a method which squares price and time. The Gann square of nine gets its name because if you look at the above chart again, the number 9 represents the completion of the first square.

The square of 9 is a spiral of numbers with an initial value “1” starting at the center. Starting from this value, the number increases as we move in a spiral form and clockwise direction. According to experts, each cell in Gann’s square of nine represents a point of vibration.

How to Calculate the Square of Nine

The numbers within the Gann square of nine also follow a certain harmonic pattern. For example, when you take a number, such as 54 from the above square, the value to the next of it (to the right), 29, is derived as follows:

The square root of the number and subtract 2, and re-square the result.

Ex: 54 is the original number

The square root of 54 = 7.348469

7.348469-2 = 5.438469

(5.438469)2 = 29 rounded off

To determine the value to the left, instead of subtracting 2, the number is added. So, we simply add +2 to the square root of 54 (7.348469), bringing the value to 9.348469. We then square this result to get a value of 87.

How does the Gann Square work?

Gann Square Of 9 Excel Sheet

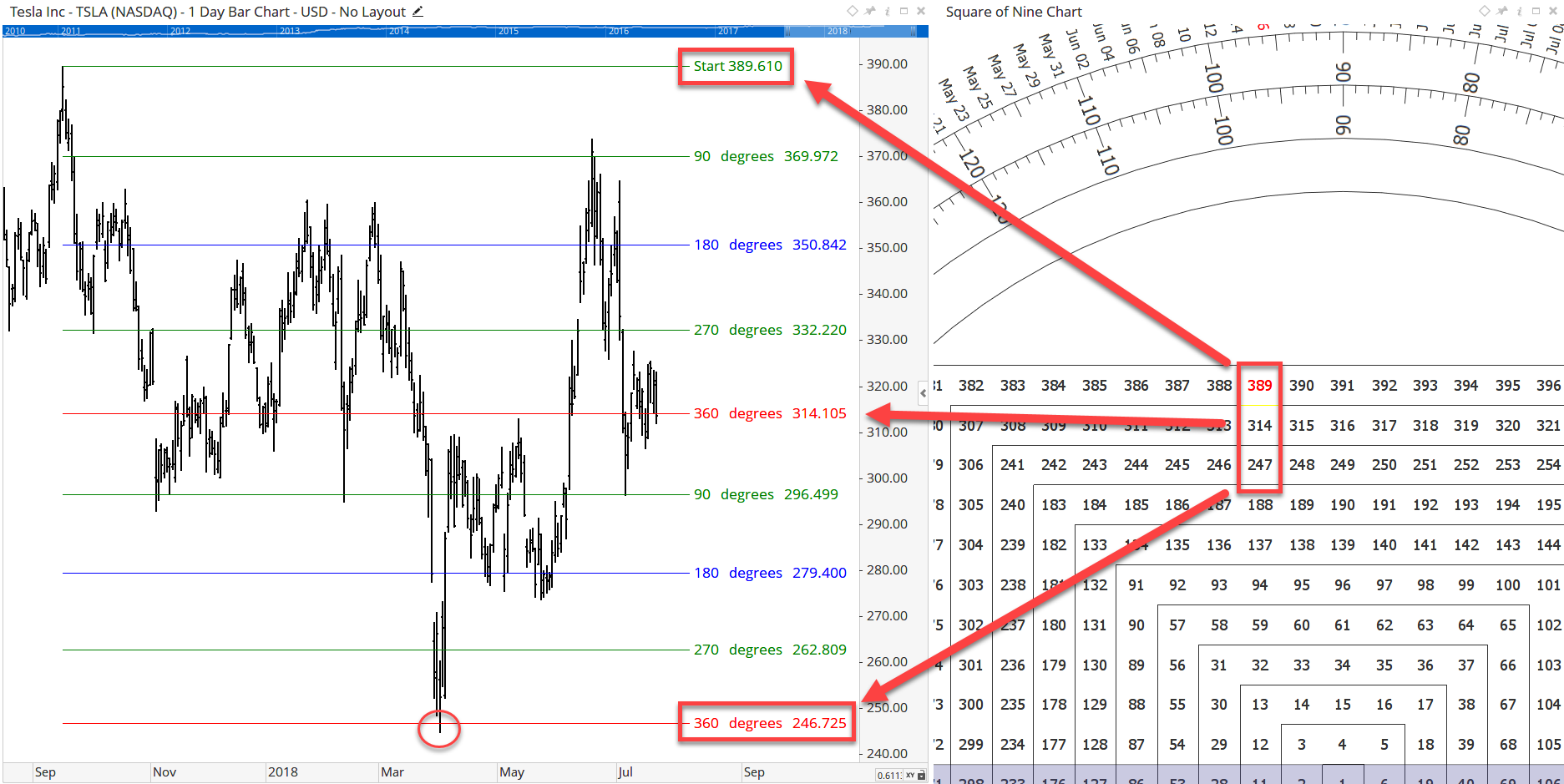

The Gann square of nine helps to identify time and price alignments in order to forecast prices.

In the Gann Square of nine, the key numbers of importance are as follows:

- 0 or 360 degrees: 2, 11, 28, 53….

- 45 degrees: 3, 13, 31, 57, 91…

- 90 degrees: 4, 15, 34, 61, 96…

- 180 degrees: 6, 19, 40, 69…

Cardinal Cross and Ordinal Cross

The next sets of important numbers fall within the cardinal cross and the ordinal cross.

The picture below shows the cardinal cross, represented in the blue horizontal and vertical lines. The ordinal cross numbers are represented in the yellow cells.

The numbers that fall in the cells represented by the cardinal and ordinal cross are key support and resistance levels.

While both are important, the ordinal crosses are of less significance and can be breached at times.

Gann Square – Cardinal and Ordinal Cross

The most important numbers as we know it occurs every 45 degrees on nine chart.

Each degree is a representation of time.

Above is a standard 1×1 chart. As an example, if price made a high of 54 on the day, if price retreats, the next support is 29, as it is the next closest number across the square of nine.

Circle Around the Square

Also, drawing a circle connecting the four corners of the squares brings the concept of angles into perspective. The angles, measured by degrees can point to potential support and resistance levels when the price is said to be moving within an angle.

The chart below shows the Gann square of nine with the circle plotted around it.

Gann Square of nine with the circle, introducing angles and degrees

Using the Gann Square

To use the Gann chart, simply replace the starting number 1 with a number of your choice and the desired step value. In the above example, the increment is 1, but you could use larger or smaller values.

The resulting numbers in the ordinal and cardinal number cells are key resistance and support levels.

Based on this information, traders can look to either buying or selling into the nearest support or resistance level.

Gann Square Of Nine Excel Formula

Gann’s square of nine also factors in planetary movements and the degree of price movement based on the circle.

There is a big difference between forecasting prices and trading. For example, one can forecast that the Emini S&P500 will rise to 2100 within a certain period of time. What the forecasting won’t tell you is whether the move to 2100 will be straight, or if the price will fall by a significant number of points before rising to 2100 and so on.

These might seem insignificant when it comes to forecasting, but they can be very things that can define a successful or a bad trade.

Additional Resources

To go deeper on Gann trading strategy, check out this awesome interview covering Gann and swing trading. The video is close to an hour and provides additional insights you can use to help develop a Gann trading plan.[2]

Lastly, if you are looking for original Gann teachings, please visit https://www.wdgann.com/. This is the site for WD Gann, Inc. which according to their site, purchased the original Gann writings from his business partner Ed Lambert in the 1970s. [3]

External References

- William Delbert Gann. Wikipedia

- Aaron Fifield, Walker, Tim. (2015). Gann Swing Trading & Technical Analysis. [Video]. YouTube.com

- About Us. WD Gann, Inc.

Gann Square Of Nine Software

POPULAR LESSONS IN THE COURSE:Awesome Day Trading StrategiesThe Volatility Contraction Pattern (VCP): How To Day Trade With It

MACD Ultimate Guide + 5 Profitable Trading Strategies [Video]

Gann Square Of Nine

How To Make Gann Square Of 9 In Excel

The VWAP Indicator Ultimate Guide And Video

Gann, a remarkable Analyst & Trader, who with his precise prediction of Time & Price analysis has been able to put the analysts of today to research his veiled coded secrets to predict markets. Gann has always been a mystery known as for his high accuracy rate & incredible market predictions with 85%+ success rate.

The proof of his ability to call the precise time for the market turns have been found in Ticker & Investment Digest, volume 5, number 2, December 1909, which shows that W.D. Gann took a total of 286 trades in the presence of William E. Gilley of which, 264 trades were profitable winning trades. His success rate during this 25 days trading period was amazingly 92%. In this 25-day period, on which the article covers in Ticker & Investment Digest, Gann was able to double his initial capital ten times for a gain of 1000% on his margin money.

During these trade recording period, it has been reported that W.D. Gann carried a miniature version of Square of Nine with him into the trading pits. The source of this information is Mr. Renato Alghini an associate of Gann’s for nearly six years. Gann believed that every top & bottom in the market has a mathematical correlation in both Time & Price. He quoted Faraday saying “there is no chance in nature, because mathematical principles of the highest order lie at the foundation of all things. There is nothing in the Universe but mathematical points of force”.

Since Gann was famous for using veiled language so that nobody could judge what his exact method of Trading/Analysis are, he would often call the same thing in different words; Square of Nine was also referred as “Pyramid” or “Old Square”.

What is Gann’s Square of Nine

The Square of Nine is similar to a wheel or a circle, it starts with the number one in the centre of the circle and then radiates out to the first square of nine. Starting with the number two to the left of the centre or the number one. It then spirals clockwise to the number nine, to form its first rotation around the Square of Nine. This rotation then continues by shifting one unit to the left of nine and will commence the next rotation at the number ten and then around to the number twenty. This spiralling expansion of numbers just continues out until you end up with a grid of numbers, relevant in price to the market your trading. The Square of Nine is essentially a time and price calculator, and calculates the square root of numbers, both odd and even numbers as well as their midpoints. It also looks for both time and price alignments from a specific starting point or price level E.g. a significant high or low point in a market. If you were to look at the numbers on the grid running down to the bottom left hand corner on the Square of Nine, you will find they are the square root of odd numbers E.g. 5x5 = 25. If you were to look at the numbers running up to the top right hand corner on the Square of Nine you will find they are the square root of even numbers e.g. 4x4 = 16. If you then look at the numbers running down to the bottom right hand corner on the Square of Nine you would find the midpoint between the square s of odd and even numbers. Using the numbers 16 and 25 as an example of our odd and even numbers you will find the number 21 representing their midpoint.

The Source of Gann’s Square of 9

Gann’s Square of Nine is one of the more exotic tools he incorporated in his trading, and while this is a relatively daunting tool that requires a fare amount of practice to master, it can certainly add a whole new dimension to your analysis. Gann never claimed to be the inventor of this tool; however he certainly developed it and refined it to be used in conjunction with financial markets. The Square of Nine has origins that date back to early Egyptian days, and when looking at it onegets the impression your actually viewing a pyramid looking down from its very top or apex and then looking down further to its actual base. It is said Gann actually discovered the Square of Nine during his travels in India, which he saw being used as a calculator by traders in the region selling their goods.